Income, Balance Sheet, and Cash Flow statements aid investors in assessing company performance and health.

Income Statement Analysis: Reveals revenue sources, expenses, and net income trends critical for evaluating profitability.

Balance Sheet Overview: Provides insights into assets, liabilities, and equity, aiding in assessing financial stability.

All publicly traded companies are required to release financial statements quarterly so investors can get a sense of how the business is doing. There are three main financial statements investors should be aware of: the income statement, the balance sheet, and the cash flow statement. In this article, we'll look at what each one is and the key information investors should pay attention to.

Financial statements are documents designed to give investors a snapshot of how a business is performing over a particular period. Financial statements answer some important questions investors should ask before buying a stock, such as:

How does the business make its money?

Have the business's revenue and earnings grown or shrunk?

How much does the business own?

How much does the business owe?

Is there more money coming in or going out?

With those questions in mind, here's a quick guide to the three main types of financial statements and what investors should pay close attention to.

A company's income statement tells you how much money a company brought in and how much of a profit (hopefully) it earned from that revenue.

Depending on the company, there might be other information on the income statement, such as sales broken down by region or product category.

An income statement starts with the company's sales and shows step by step how it turns them into profit.

It's also worth mentioning that there are typically several columns of numbers on an income statement to show how the current period compares to the same period last year. You'll typically see the latest quarter compared with the same quarter a year before, and the company's year to date (or full year) compared to the same period from the prior year. Comparing the company's current income to the previous year’s provides a good sense of how the business is growing.

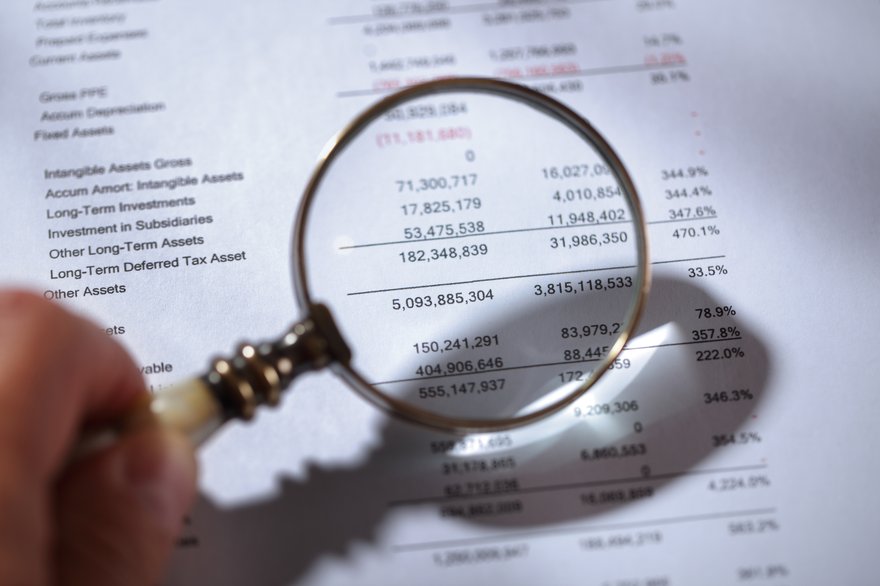

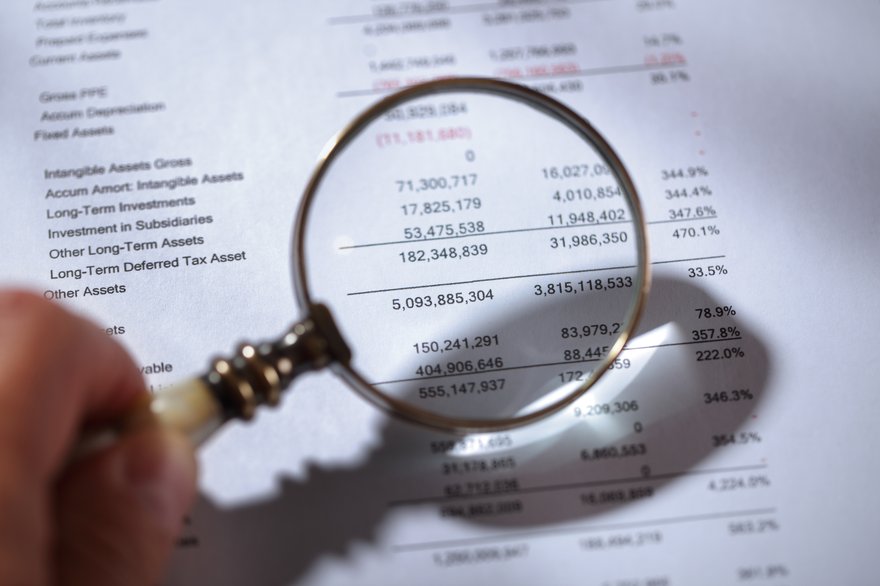

A balance sheet gives you a snapshot of a company's financial condition at a given time (typically the end of a quarter). And as with the income statement, the data is typically presented as a comparison between the current period and the same time a year prior.

There are three sections on a balance sheet:

A company's cash flow statement shows the money flowing into and out of the business. This is broken down into a few categories:

All of these categories added together produce the company's total cash flow. A positive number indicates that the company's cash increased during the period, while a negative number shows that the cash decreased. Just under the cash flow number will be a total of the cash and cash equivalents the company currently has.

Investing can be the most surefire path to becoming and remaining financially free. Here's how to get started the right way.

So what is the stock market anyway? We break it down.

Exchange-traded funds let an investor buy lots of stocks and bonds at once.

Which retirement plan is right for you and your needs?

You can get a company's financial statements straight from the source—the company itself. Simply go to the company's investor relations (IR) page and look for its most recent quarterly earnings report, which is usually under a "news," "press releases," or "financials" tab at the top of the page. Many companies keep their latest results as a focal point on their main IR page. For example, on Apple's investor relations page, the first item listed is a press release with the company's latest results. Directly on the press release is a link to the consolidated financial statements, which contains the three main documents discussed above.

There are certainly other ways to find a company's financial statements. For example, you can go directly to the SEC's website and look up the company's latest quarterly report. Additionally, your brokerage might offer a view of the financial statements as part of its stock quotes, which is an easy way to find them.

The bottom line is that for all publicly traded companies listed on major U.S. exchanges, financial statements are full of information, updated quarterly, and readily available to help investors like you make informed decisions.

There are three main financial statements investors should be aware of: the income statement, the balance sheet, and the cash flow statement.

You can get a company's financial statements straight from the source—the company itself. Simply go to the company's investor relations (IR) page and look for its most recent quarterly earnings report, which is usually under a "news," "press releases," or "financials" tab at the top of the page. Many companies keep their latest results as a focal point on their main IR page.

Matt Frankel has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.